5 Tips for Agile Budget Planning

It’s budget planning season, the time of year organizations evaluate the past year and conceive a plan for successfully moving forward. It can be daunting, especially as a global pandemic continues. For skilled nursing and senior living operators, planning next year’s budget requires careful scrutiny, knowing that the effects of COVID-19 are still a threat, and wondering how to plan for the unknowns.

Many lessons have been learned over the past 18 months. Traditional “business-as-usual” budgeting strategies and processes need a new approach. Corporate financial leaders know that they need the ability to react and reforecast with speed and accuracy – on an ongoing basis. The agility to match resources with strategy over time can only be achieved with a system of green data. The knowledge of where your P&L stands at any moment in time is essential to making evidence-based decisions to keep the company on course.

The 12-Month Budget

Amid ongoing, unprecedented uncertainty, a detailed long term budget may seem like a futile exercise. Yet, the need for speed, visibility, and cost control remains. Budget planning becomes a balancing act of business strategy and resource allocation.

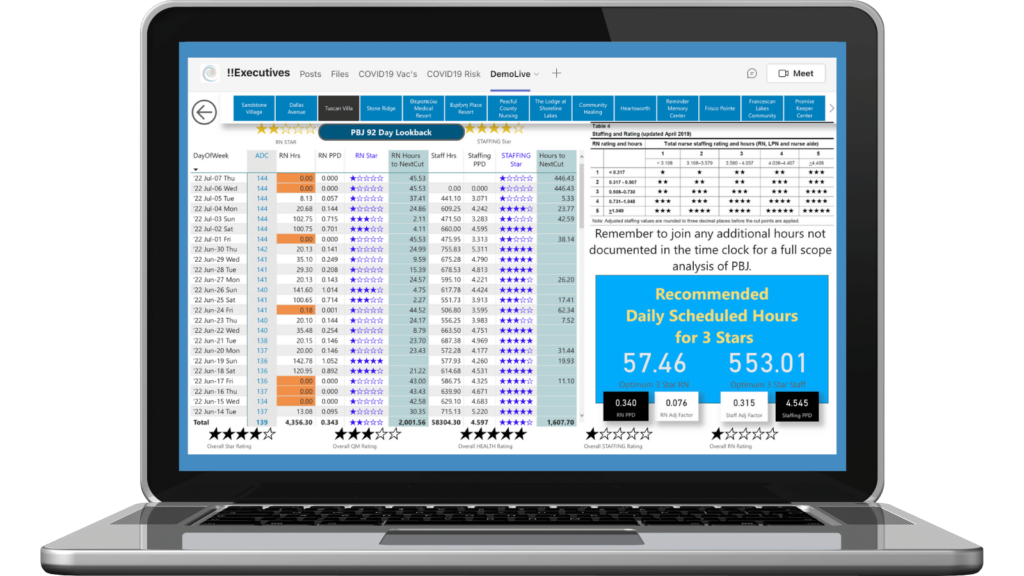

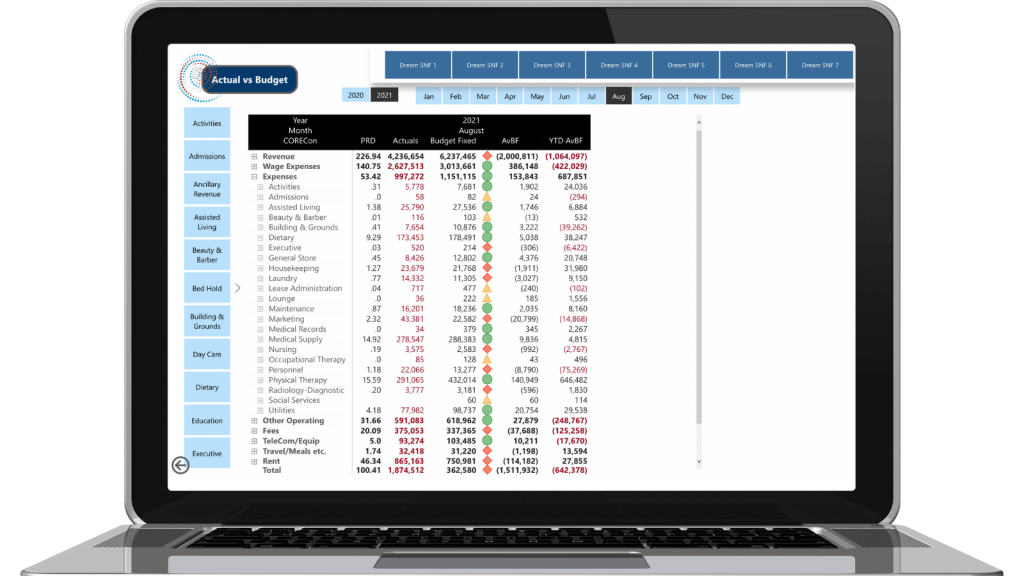

DreamCORE Dashboards are the tool to reimagine agile, strategic budgeting.

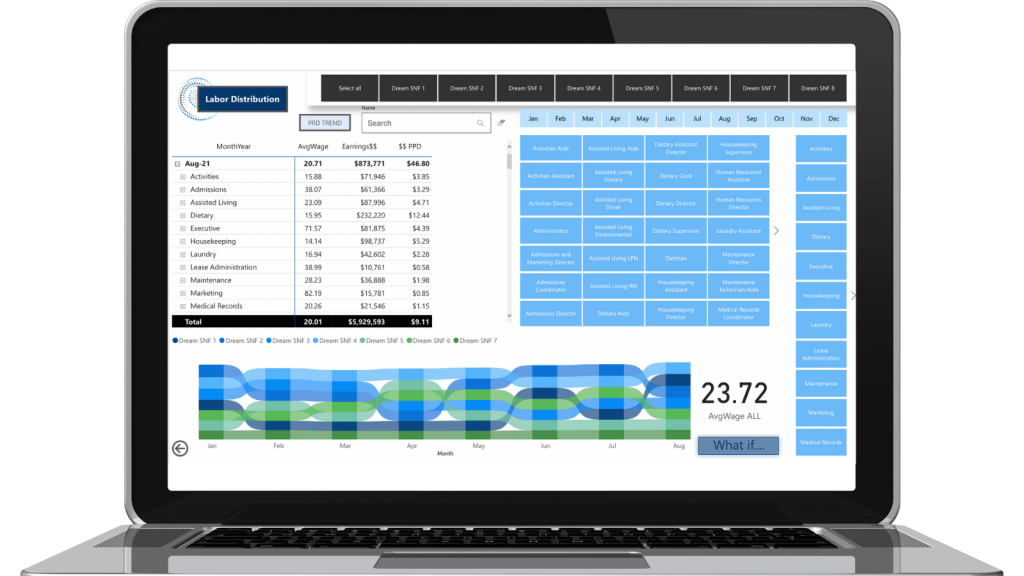

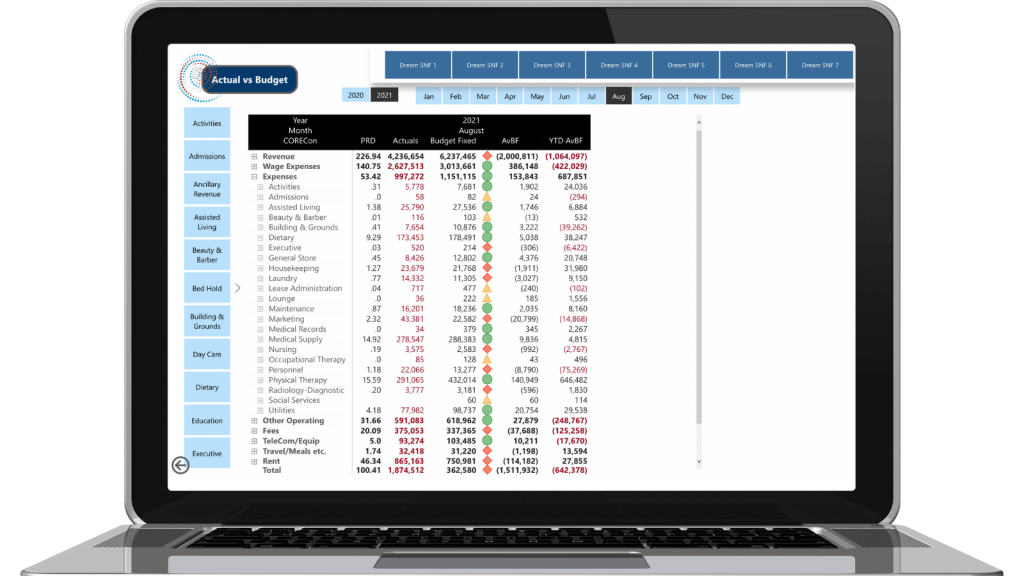

Delivered in dynamic financials, DreamCORE Dashboards provide green data, updated daily. This strategic, robust financial tracking system looks back historically to show not only where you’ve traveled but the road ahead of you as well. Your data, assembled chronologically, with the ability to scroll and drill down by department, eliminates the scrambling to find everything you need and the shuffling of multiple sources.

Ongoing Reforecasting

DreamCORE Dashboards offer predictive analytics with a “What If” feature. Want to determine your Housekeeping budget based on PPD? Simply plug in your desired PPD and DreamCORE will calculate the amount.

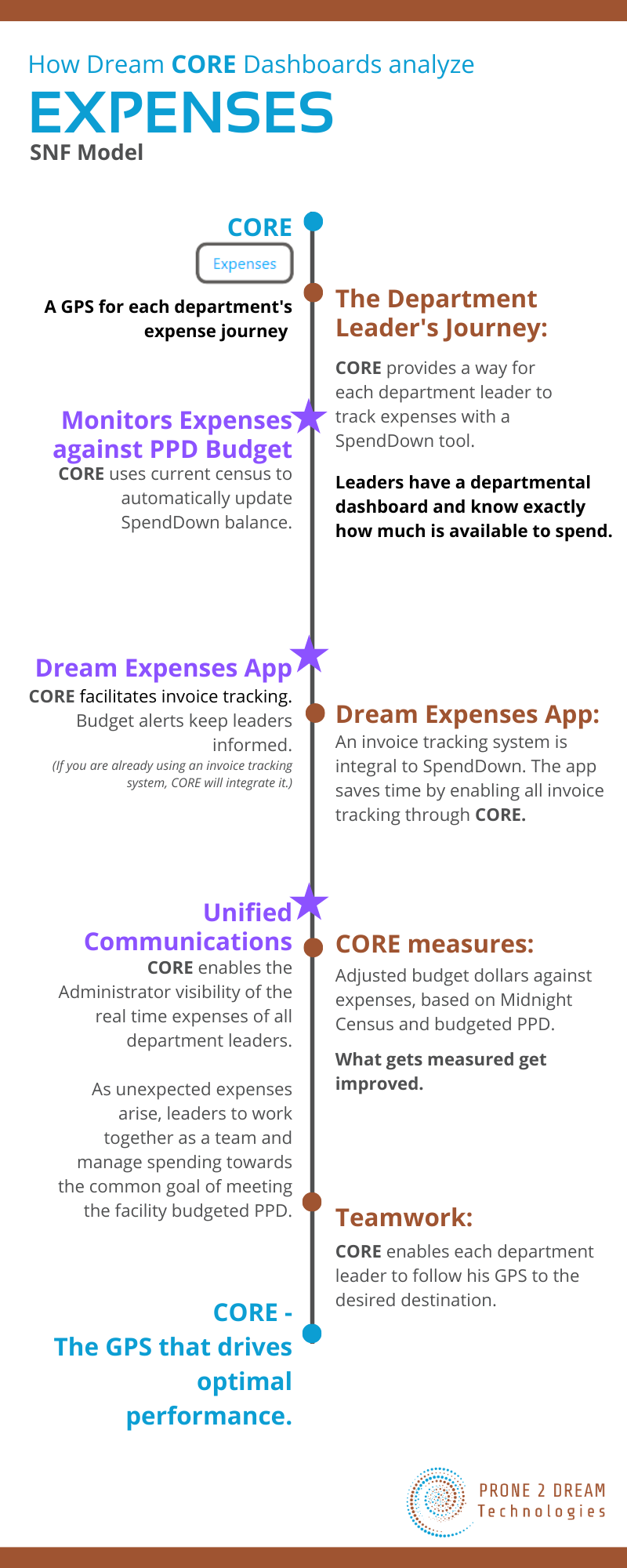

The pandemic showed us the financial impact of a wildly swinging census. DreamCORE Dashboards updates your census daily, and recalculates spend-down accordingly. Each of your front line managers who make spending decisions has daily access to their budget, adjusted by census. How much better could you control expenses when all front line teams are trained to contribute to the overall company financial strategy?

5 Tips for your 2022 Budget

1.Assemble historical data for the past two years

If you’re already using DreamCORE Dashboards, this work is done and your 2022 budgeting is well underway. DreamCORE Dashboards integrate your EHR, Book of Record, and Payroll/TimeClock systems into a relevant order for evidence-based decision-making.

2. Evaluate strengths and weaknesses from this data

While this can be an arduous task, data speaks the truth. With DreamCORE Dashboards, red flag anomalies in your data alert you daily enabling the quick action to get back on course. Weaknesses can be easily reduced in real time.

3. Convene with company strategic leaders

Senior management and your finance team have valuable input. Weave the business plan into the budget, strategize and decide how to address the inevitable unknowns. Determine new KPIs and how to pivot when needed.

4. Engage your strongest front line leaders

Essentially these are your budget managers. A large proportion of the spending happens In the facilities. Your front line has insight to challenges you may not be prioritizing. Learn from them for more realistic budget planning.

5. Book a live demo of DreamCORE Dashboards

Our current clients are breathing a sigh of relief knowing they have an agile system for spending management and cost control. The “work” of creating a 12-month budget is largely complete – an easy review of historical data, a relevant view and breakdown of revenue, and daily drillable access to every dollar spent.

Budget planning for a new fiscal year enables a strategic plan for managing the revenue and expenses. The budget provides a plan for all teams in the organization to follow. Yet, the past 18 months have shown us that a static plan is useless.

With access to accurate historical financials and predictive analytics, your budget takes on a dynamic reality. Ongoing forecasting, departmental budgets adjusting to census, year over year and month over month comparisons are the new approach to financial management.

DreamCORE Dashboards is the GPS to keep your business on course to success. Contact us today to get started – you’re just 3 logins away from powerful analytics.